Unleashing the Power of Stock Prop Trading Firms

In today's rapidly evolving financial landscape, stock prop trading firms have emerged as a vital player for aspiring traders and seasoned professionals alike. Understanding these firms, their operations, and how they can benefit you is essential for anyone looking to thrive in the competitive world of trading.

What Are Stock Prop Trading Firms?

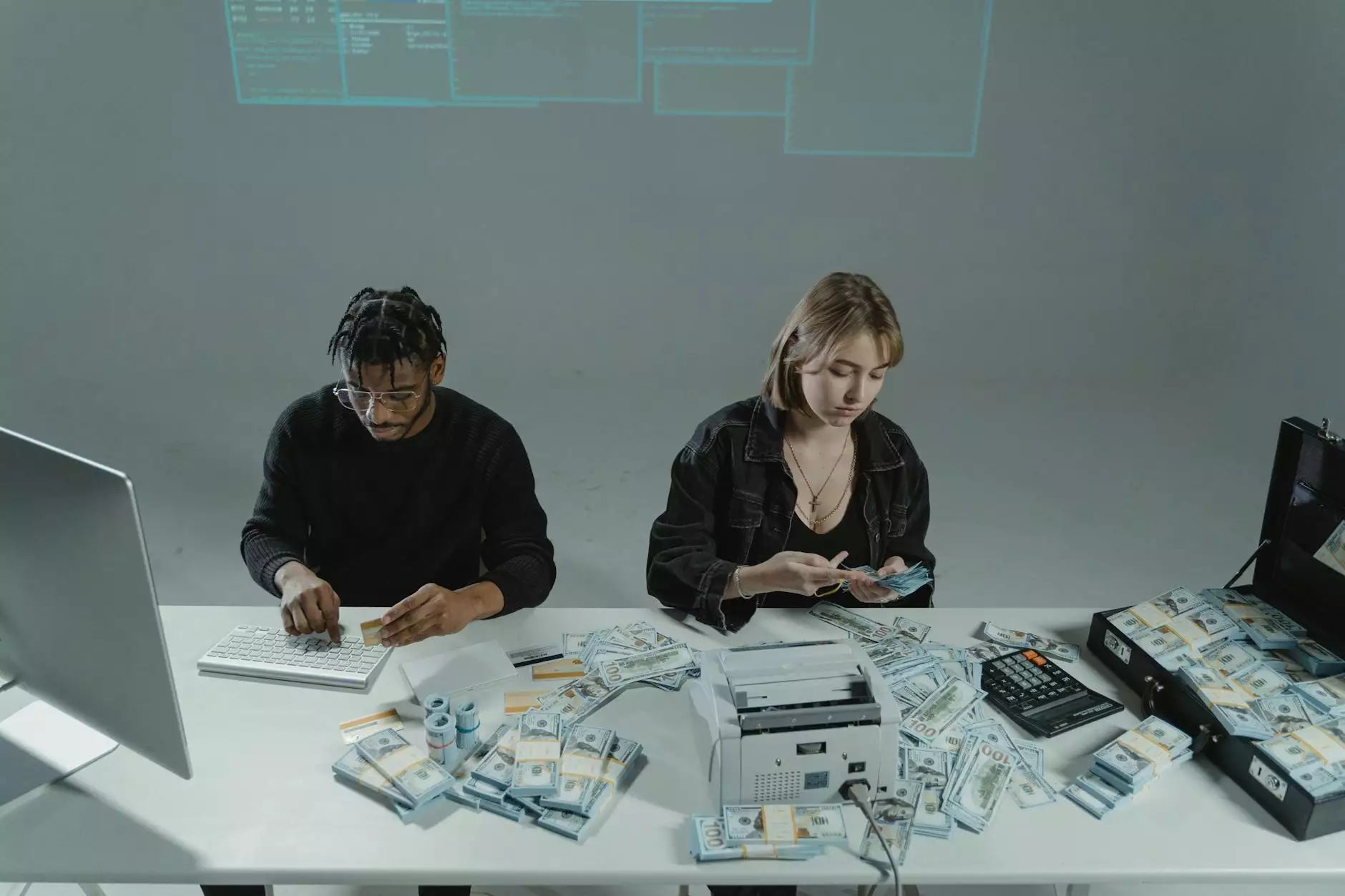

Stock prop trading firms, often referred to as proprietary trading firms, are businesses that use their own capital to engage in trading activities. Unlike traditional brokerage firms, which primarily earn income through commissions, prop trading firms aim to generate profits by trading on their own behalf. This unique model allows them to take on higher risks and potentially reap larger rewards.

The Advantages of Joining a Stock Prop Trading Firm

Engaging with stock prop trading firms offers numerous advantages that can significantly enhance your trading career. Below, we outline some of the key benefits:

- Access to Capital: One of the biggest advantages is access to significant capital. This allows traders to increase their buying power and take advantage of larger market opportunities.

- Reduced Personal Risk: By trading with firm capital, traders can mitigate their personal financial risk. Profits are shared, minimizing the potential loss on individual traders.

- Advanced Trading Tools: Most prop firms provide their traders with sophisticated trading platforms, tools, and technologies that can enhance their trading strategies.

- Expert Guidance: Many firms offer mentorship and training resources, which are invaluable for both novice and experienced traders.

- Collaborative Environment: Being part of a trading team encourages knowledge sharing, enhancing your trading acumen.

How to Choose the Right Stock Prop Trading Firm

Selecting the right stock prop trading firm can be a daunting task, given the multitude of firms available. Here are several critical factors to consider:

1. Reputation and Credibility

It's vital to research the reputation of the firm. Look for reviews and testimonials from other traders. A reputable firm should have a track record of success and positive trader experiences.

2. Capital Allocation

Different firms have varying policies on how much capital they allocate to traders. Ensure you choose a firm that aligns with your trading ambitions and risk tolerance.

3. Training and Support

Evaluate the quality of training and the support provided. This plays a crucial role in your development as a trader. The best firms offer comprehensive training programs and ongoing mentorship.

4. Fee Structure

Understanding the fee structure is essential. Some firms charge monthly fees or take a percentage of profits. Analyze these fees to ensure they are reasonable and advantageous for your trading journey.

5. Trading Policies

Different prop trading firms may have specific trading policies and restrictions. Make sure these policies align with your trading style and strategy.

Strategies for Success in Stock Prop Trading

Joining a stock prop trading firm equips traders with the resources they need, but success ultimately depends on the strategies employed. Here are several strategies that can elevate your performance:

1. Risk Management

Effective risk management is paramount. Limit your exposure on individual trades and use stop-loss orders to safeguard your capital.

2. Diversification

Diversifying your trading portfolio can minimize risks. Instead of putting all your capital into one asset, spread it across multiple trades and sectors.

3. Continuous Learning

The financial markets are continuously changing. Stay updated with market news, trends, and educational resources provided by your firm to refine your trading skills.

4. Developing a Trading Plan

Having a structured trading plan sets the foundation for your trading activities. This plan should include your trading goals, risk tolerance, and specific strategies.

The Future of Stock Prop Trading Firms

The landscape of stock prop trading firms continues to evolve. With advancements in technology and the increasing accessibility of financial markets, these firms are likely to play an even more significant role in shaping the trading industry.

Artificial Intelligence (AI) and algorithmic trading are making waves in prop trading, providing enhanced analytical tools for traders. These technologies allow traders to make data-driven decisions, optimizing trading outcomes.

Emphasis on Compliance

As the regulatory landscape tightens, prop trading firms will need to ensure compliance with numerous financial regulations. This will lead to increased transparency and accountability within these firms.

Conclusion: Embrace the Opportunities

Stock prop trading firms present an exciting opportunity for traders looking to elevate their trading experience. With access to capital, advanced tools, and a collaborative environment, these firms serve as a launchpad for success in the financial markets.

Embrace the opportunities provided by stock prop trading firms, invest in your education, and develop robust trading strategies that leverage the advantages offered by these dynamic entities. With determination and the right resources at your disposal, you can navigate the trading world effectively and emerge victorious.